Payroll processing is a critical function for businesses of all sizes, yet it can be time-consuming, complex, and prone to errors. From calculating wages and deductions to ensuring compliance with tax laws and regulations, payroll administration requires specialized knowledge and attention to detail. In recent years, many businesses have turned to payroll outsourcing as a strategic solution to streamline operations, reduce costs, and mitigate compliance risks.

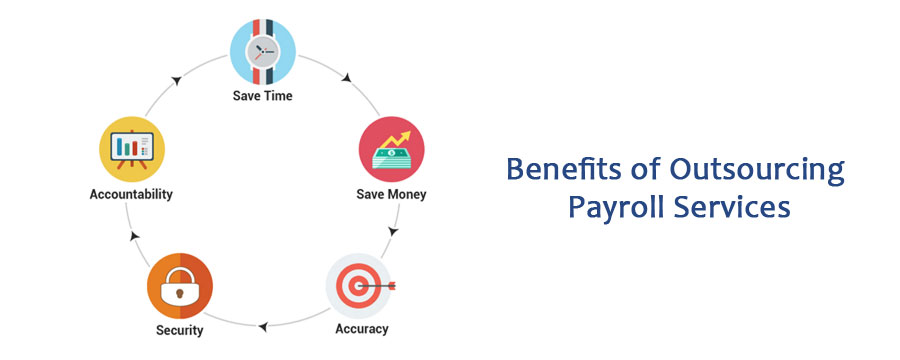

By partnering with a reputable payroll outsourcing services provider. Businesses can optimize their payroll operations, improve efficiency and accuracy, and enhance employee satisfaction and trust. In today’s competitive business environment, payroll outsourcing has become a strategic imperative for businesses looking to achieve operational excellence, compliance, and financial success. In this guide, we’ll explore the top advantages of payroll outsourcing and how it can benefit businesses across various industries.

1. Time and Cost Savings

One of the primary advantages of payroll outsourcing is the significant bape hoodie time and cost savings it offers businesses. Outsourcing payroll eliminates the need for businesses to invest in expensive payroll software, hardware, and infrastructure. Additionally, it reduces the administrative burden associated with payroll processing, such as data entry, calculations, and tax filings. By outsourcing payroll, businesses can redirect valuable time and resources toward core business activities, strategic initiatives, and revenue-generating opportunities, ultimately improving efficiency and productivity across the organization.

2. Expertise and Compliance

Payroll processing involves navigating a complex web of federal, state, and local tax laws, regulations, and reporting requirements. Staying compliant with these regulations can be challenging and time-consuming for businesses, especially those with limited resources and expertise in payroll administration. Outsourcing payroll to a reputable provider ensures that payroll professionals with specialized knowledge and experience handle all aspects of payroll processing, including tax calculations, deductions, filings, and compliance updates. By entrusting payroll to experts, businesses can minimize compliance risks, avoid costly penalties, and maintain confidence in their payroll operations.

3. Accuracy and Reliability

Accuracy is paramount in payroll processing, as even minor errors can lead to significant consequences, including disgruntled employees, regulatory fines, and reputational damage. Payroll outsourcing providers leverage advanced payroll software and automated processes to ensure accuracy and reliability in payroll calculations, deductions, and filings. Additionally, outsourcing providers conduct regular audits and quality checks to identify and correct errors before they impact employees or the business. By outsourcing payroll, businesses can rest assured that their payroll processes are accurate, reliable, and compliant with all applicable laws and regulations.

Read more about how x*x*x is equal to 2 and how it is solved.

4. Enhanced Data Security

Data security is a top concern for businesses when it comes to payroll processing, as payroll data contains sensitive information, such as employee Social Security numbers, salaries, and bank account details. Payroll outsourcing providers adhere to stringent security protocols and encryption standards to protect payroll data from unauthorized access, breaches, and cyber threats. They invest in state-of-the-art security technologies and data encryption techniques to safeguard sensitive information and ensure confidentiality, integrity, and availability of payroll data. By outsourcing payroll, businesses can mitigate data security risks and maintain the privacy and trust of their employees.

5. Scalability and Flexibility

Businesses’ payroll needs can fluctuate corteiz over time due to factors such as seasonal fluctuations, business growth, and changes in workforce size. Payroll outsourcing offers scalability and flexibility to accommodate businesses’ evolving needs and requirements. Outsourcing providers offer customizable payroll solutions that can scale up or down based on business demands, without the need for costly upgrades or additional resources. Whether businesses need to add new employees, expand into new markets, or adjust payroll schedules, outsourcing providers can adapt their services to meet changing needs effectively and efficiently.

6. Access to Advanced Technology

Payroll outsourcing providers invest in advanced payroll software and technology platforms that offer robust features, functionalities, and capabilities beyond what traditional payroll systems can provide. These platforms often include self-service portals for employees to access their pay stubs, update personal information, and submit time-off requests, reducing administrative overhead and improving employee satisfaction. Additionally, outsourcing providers leverage automation and artificial intelligence to streamline payroll processes, minimize manual intervention, and enhance accuracy and efficiency. By outsourcing payroll, businesses gain access to cutting-edge technology and tools that optimize payroll operations and drive business performance.

Conclusion

Payroll outsourcing with MonkTaxSolutions offers numerous advantages for businesses seeking to streamline operations, reduce costs, and mitigate compliance risks. From time and cost savings to expertise and compliance, accuracy and reliability, enhanced data security, scalability and flexibility, and access to advanced technology, payroll outsourcing empowers businesses to focus on their core competencies and strategic objectives while entrusting payroll processing to experts.